In the current economic environment with rising interest rates and high inflation, it would be understandable if businesses were reluctant to access the credit markets. After all, the price of money has risen dramatically since last year at this time when interest rates were hovering near zero. However, businesses are not shying away from debt and, in fact, are turning to commercial and industrial loans more and more. The commercial real estate market, however, is feeling the pain.

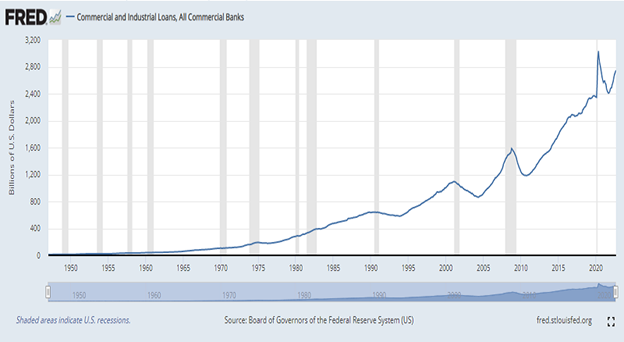

The catalysts for the increase in business borrowing are twofold: a need among business owners for liquidity coupled with soaring payroll costs amid wage inflation. Loan issuance by U.S. commercial banks rose to approximately $2.8 trillion for the week ended Oct. 12, Federal Reserve data in the below chart show.

This compares to $2.771 trillion in the week prior. This amount may hover below the pandemic peak of over $3 trillion in business loan issuance, but the milestone was reached in the spring of 2020, fueled by government stimulus funds.

TD Bank is among the financial institutions that are seeing evidence of this trend despite the economic headwinds, chief among which for banks has been rates hovering at their highest rate in 14 years. TD Bank’s Chris Giamo, head of U.S. commercial lending, in an interview with Bloomberg described loan growth as “moderate,” saying,

“Depending on where rates end up leveling off, in certain sectors, you may see flat to low growth, but in others, you’ll still see growth.”

TD Bank’s business loan book expanded by 2% between May and July 2022 vs. the year-ago period (minus any pandemic-related PPP effect.) Businesses have been hoarding cash from early in the health crisis, as a result of which they are hanging in there today. Nevertheless, small businesses continue to face a perfect storm of a talent shortage, sky-high inflation, and increasing interest rates. Businesses have been resilient in the face of these challenges, and their portfolios are not reflecting the “negative trends,” according to Giamo.

Meanwhile, business loan delinquencies hovered at a rate of 1.02% as of the end of the first half of the year, down from 1.13% at year-end 2021, as per Fed data. They are a far cry from the 4.47% level reached around the time of the Great Financial Crisis.

It’s also possible that small business loans are about to get more affordable for entrepreneurs as Washington, D.C. seeks to prop them up. A spending bill dubbed the Access Business Credit (ABC) Act is designed to incentivize small business owners to take out loans by making them more affordable. The legislation is framed so that community banks could get a tax break on the interest income they earn from issuing small business loans.

Commercial Real Estate Market

Meanwhile, the rising rate environment has taken a toll on the commercial real estate market and multi-family commercial borrowing and lending in particular.

According to the Mortgage Bankers Association (MBA), commercial and multifamily mortgage borrowing and lending are estimated to come in at $766 billion in 2022, a 14% decline vs. 2021 levels. Higher interest rates coupled with economic uncertainty have put a damper on activity in the second half of this year.

Multifamily lending is projected to fall to $455 billion this year, down 7% vs. last year’s all-time high of $487 billion. However, there is a light at the end of the tunnel as the borrowing and lending market should recover next year to $848 billion and $451 billion in total commercial real estate lending and multifamily lending, respectively, the MBA says.

Patrick Carroll, Founder and CEO of a firm that bears his name, told CNBC, “Lending is all but dried up.” He said lenders have no clarity into which direction rents are headed, or rates for that matter. So, they’re on the sidelines for financing, which has brought the commercial real estate market to an abrupt halt.

The scene reminds Carroll of when the housing bubble burst. He believes it’s possible that the real estate market could be headed for another downturn, the proportions of which the industry hasn’t seen since 2008. He believes it’s a debt and financing issue, saying that lenders tend to overextend themselves and forget about bad times.” He warns that bad times are coming.