In today’s fast-paced and interconnected world, banking is undergoing a profound revolution. Digital banking, the futuristic way of managing finances, has emerged as a game-changer, offering individuals unprecedented convenience, efficiency, and control over their money.

With the click of a button or the tap of a screen, customers can now access a wide array of financial services, make transactions, and monitor their accounts from the comfort of their homes or while on the go.

In this article, we will discuss the captivating benefits of digital banking, exploring its transformative power and the exciting opportunities it holds for the future of money management. So, get ready as we embark on a journey to unravel the marvels of digital banking, where technology and finance converge to shape a new era of financial empowerment.

What is digital banking?

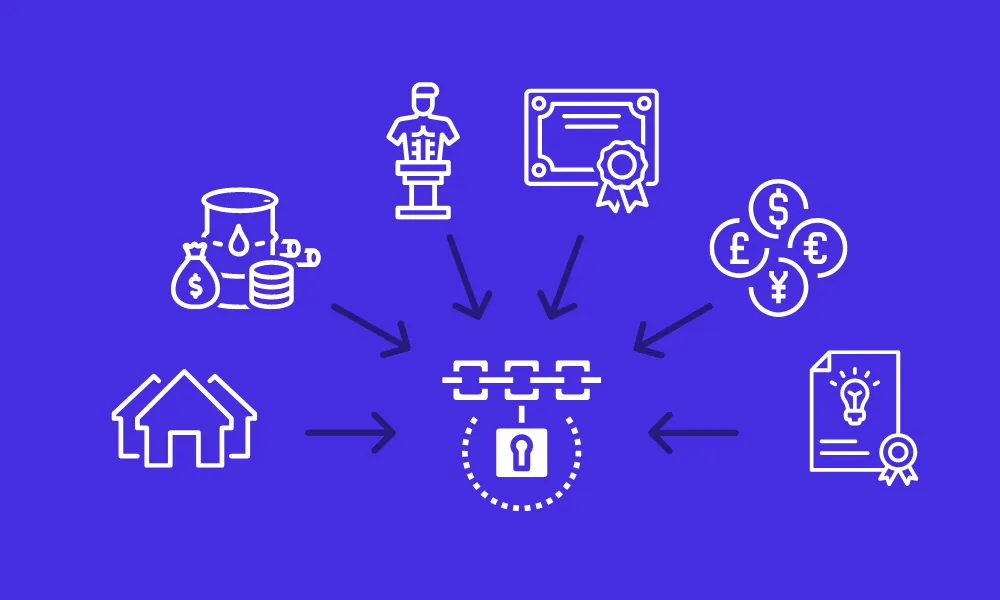

Online banking involves performing banking tasks using online portals or mobile apps. In online banking, operations such as depositing money or accessing transaction records can now be easily carried out online rather than through physical visits.

The integration of digital banking has also brought about new functionalities such as automatic payments, credit card management, financial tracking, analysis, and others. Such features have helped simplify banking-related procedures to a great extent.

-

What are the benefits offered by digital banking?

-

Convenience at your fingertips:

Digital banking offers customers an unprecedented level of convenience and accessibility. With the ability to access their accounts through online portals and mobile apps at any time, customers can now oversee their balances, check their transactions, and make payments from anywhere in the world. Managing their financial matters while on the move has given people the power to handle their finances in ways they never could.

-

Enhanced security measures:

Although digital banking has been criticized for security issues, technology has greatly enhanced safety measures in digital banking. Saving online bank and financial establishments are now implementing encryption, multi-factor authentication, and biometric technologies to protect customer data and secure transactions.

Additionally, digital banking apps have built-in security features, such as real-time transaction alerts and the ability to freeze temporarily or block cards in case of suspected fraud contributing to a secure banking environment. In light of these protective measures, digital banking has emerged as an equally, if not more, secure method than traditional banking.

-

Saving time and money:

Transactions that used to require multiple steps and manual processes can now be completed quickly and easily online. Money transfers, bill payments, and savings account management can all be done within minutes, saving precious time and reducing administrative burdens. Moreover, digital banking often comes with many rewards in basic transactions, resulting in consumer cost savings.

-

Financial Inclusion:

Digital banking has played a critical role in enhancing financial inclusion. It has opened banking saving account to the rural populations, particularly in developing countries. With the addition of mobile phones, individuals without access to traditional banking services can now perform basic financial transactions through digital banking. This inclusion enables financial empowerment, access to credit, and participation in the formal economy for millions of previously excluded people.

Ultimately, digital banking has provided numerous advantages that have altered how we handle our finances. These include advantages such as ease of use and availability, cost efficiency, better financial management, and improved security measures.

We can anticipate further developments in digital banking as technology advances, bringing additional innovative features and services to enhance the overall experience and making it an essential tool for individuals and companies alike in the future.