Debt is something that many people accumulate throughout the course of their life. A house or car loan are two examples of secured loans that are more controllable than credit card debt. At other times, we may feel obliged to take on a high-cost debt, such as a credit card balance or a loan with exorbitant interest rates. We might easily incur more debt than we could ever hope to repay if any of these scenarios comes to fruition. Tips to understand steps to get out of debt.

However, there is still a chance. You may avoid falling into debt forever by learning to control your spending habits. We hope these suggestions may help you break free from your never-ending cycle of debt.

You may want to look into a debt consolidation company

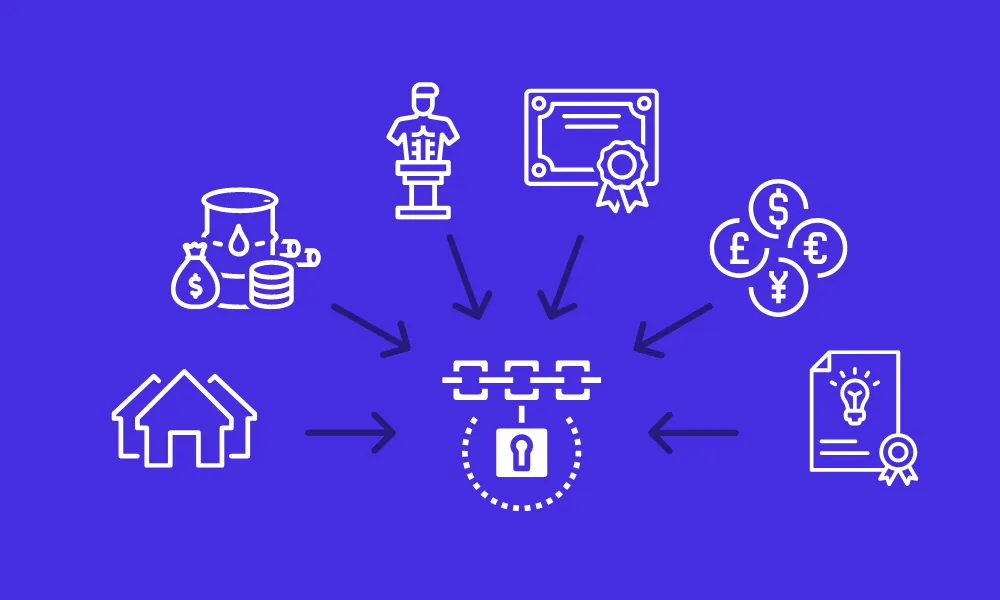

Debt consolidation is one of the best ways to get out from under a mountain of debt. Getting a new Personal Loan at a lower interest rate can allow you to settle multiple outstanding payments at once. Instead of making monthly payments on numerous different loans, debt consolidation allows you to make one payment each month towards a single balance.

If you don’t want to use a debt consolidation loan and instead want to pay off your debts one by one, then you should focus on the loans with the highest interest rates first. Finding the most expensive debt is the first step in developing a strategy to pay it off.

Creating and adhering to a budget is crucial

Having a budget in place is also crucial. Until you have reached a degree of financial stability, you should avoid making any rash financial commitments, no matter how big or small. This is a sign that your use of the credit card has to be reduced.

Maximise your earnings

You can reduce your financial obligations by taking up freelance employment to increase your income. You’ll be able to eliminate your debt faster and with less effort this way.

Think about moving your debt to a card with a lower interest rate. If you have a high credit card amount and are offered a special interest rate on a new credit card, you may want to consider transferring the balance.

You should receive some help from an expert if you wish to escape the debt cycle. If you need help managing your debt, there are companies you can turn to for advice. They also give you a lot of flexibility in terms of making payments.