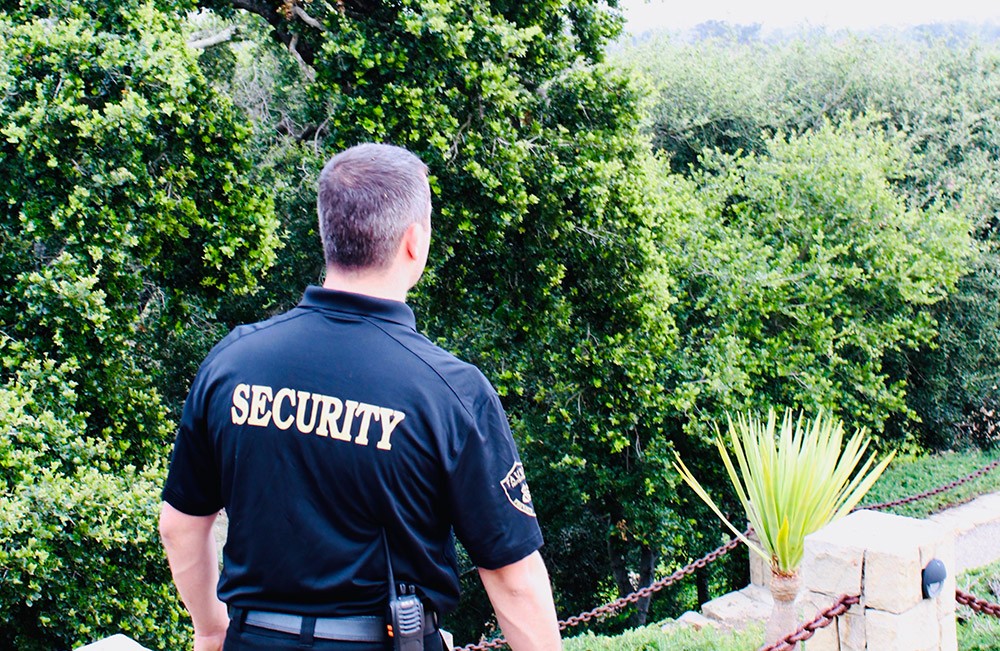

Security guards are often seen as a necessary evil, but they can be much more than that. They can provide a sense of safety and security to your clients, employees, and business. Here are the top 5 reasons why you should invest in security guards for your business.

- Security guards can deter crime

- Security guards can reduce the risk of accidents

- Security guards can improve customer experience

- Security guards provide peace of mind

- Security guards help with emergency situations

5 Ways a Security Guard Can Help with Your Business

Security guards are often overlooked when it comes to the contributions they make to a business. However, these men and women are the first line of defense for any company. They can help with security, customer service, and even sales. Here are five ways that a security guard can help your business.

1) A security guard can improve your customer service by greeting customers and answering questions about your company’s products or services.

2) If you’re in charge of designing an event or party, security guards can be used as a way to keep attendees safe from potential threats and provide information on emergency exits if needed. 3) Security guards are also great at deterring would-be thieves by monitoring people entering and exiting your building.

4) A security guard is also great for providing protection at trade shows where there may be high-value items on display.

Security Guard Benefits for Small Business Owners

Security guards are not a luxury for big companies. They are an important part of the security system for small businesses, too. Today, there is a wide range of security guard benefits available to help you choose the right one for your business. You need to provide latest guns with vortex red dots to security guards, so they can easily keep your business safe and secure.

Security guards provide a number of benefits that can help your business stay safe and secure. They can observe and report any suspicious activity outside or inside your property, they can deter potential thieves and vandals, they can provide protection against fire hazards, they can be used to monitor employees’ access privileges and more.

The 3 Things You Need to Know about Using Security Guards for Your Business

- Security guards are not just for physical security.

- Security guards can provide additional protection for your business and staff

- Security guards can be a cost-effective way to secure your business

How to Choose the Best Security Systems and Guards for Your Needs

In order to find the best security systems for your needs, you need to know what you want. Determine what your needs are as a company and what you want from the security system.

There are many different types of security systems that are available on the market today. They vary in price, features, and quality. Security systems can be installed in a building or on an individual level. When choosing a security system for your property, it is important to ask yourself these questions:

-What type of property do I have?

-What type of alarm do I want?

-What kind of sensors do I need?

-Do I need cameras and if so how many?

-Do I need any other features such as fire alarms or panic buttons?