Investing in real estate is a wise move, but it’s not without its fair share of risks. That’s where Property Additional Coverage comes into play. It’s designed to fortify your property’s protection beyond the basics. This vital security net ensures that unforeseen circumstances won’t jeopardize your investment. Property Additional Coverage, abbreviated as PAC, steps in when standard insurance may fall short. It’s your financial safety buffer in the realm of property ownership. This invaluable protection encompasses a range of scenarios, ensuring that your investments remain solid in the face of adversity.

The Importance of Property Insurance

Protecting Your Investment

When it comes to safeguarding your investments, property insurance plays a pivotal role. Whether a homeowner or a real estate investor, your property represents a significant financial commitment. Property insurance serves as a shield, providing security for your valuable assets. In the unpredictable world of real estate, protecting your investment is more than a prudent choice; it’s a necessity. This coverage ensures that your property remains a safe haven, preserving its value and allowing you to breathe easy, knowing your investment is secure.

Mitigating Risks and Losses

Property insurance is your ally in mitigating risks and minimizing potential losses. Life is unpredictable, and property-related challenges can arise at any time. Natural disasters, accidents, and unforeseen events can all pose threats to your property’s well-being. However, with property insurance, you’re equipped to face these challenges head-on. It acts as a safety net, providing financial support when you need it most. By mitigating risks and losses, property insurance protects your investment and gives you peace of mind, knowing that you’re prepared for the unexpected twists and turns that life may throw your way.

Understanding Property Additional Coverage

What is Property Additional Coverage?

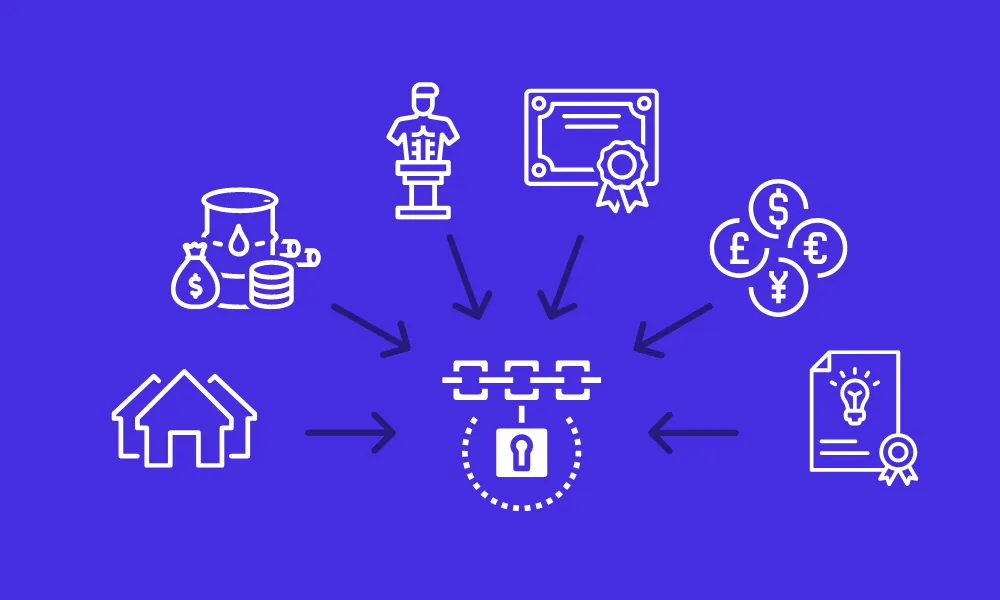

Property Additional Coverage is a crucial aspect of safeguarding your investments. It serves as a protective shield for your valuable assets, providing financial security when unexpected events occur. This coverage extends beyond standard policies, addressing specific risks that may be overlooked. Think of it as a tailored insurance safety net designed to shield you from potential financial losses related to your property.

Types of Additional Coverage

Understanding the different types of Property Additional Coverage is essential when protecting your investments. These options encompass a range of scenarios, each with its unique benefits. Some common types include flood insurance, earthquake insurance, and endorsements for valuable personal items. By selecting the right additional coverage, you can customize your insurance to match your needs, ensuring you’re well-protected in various situations.

Tailoring Coverage to Your Needs

Tailoring your Property Additional Coverage to your needs is smart and practical. This involves a thoughtful evaluation of your assets and their potential risks. You may want to consider those specific coverages if you live in an area prone to flooding or earthquakes. On the other hand, if you own valuable jewelry or art, endorsements for these items can be a wise choice. The essence of Property Additional Coverage lies in its ability to be precisely tailored, offering you peace of mind in the face of unforeseen events.

Benefits of Property Additional Coverage

Enhanced Protection

Regarding safeguarding your investments, additional property coverage is your most valuable ally. This extended protection goes beyond the standard coverage, filling in the gaps and ensuring you’re shielded from a broader range of risks. Whether it’s protecting against natural disasters, theft, or unforeseen accidents, property additional coverage steps up to the plate. The extra layer of defense ensures you’re adequately shielded against the unpredictable.

Peace of Mind

Property additional coverage is more than just a financial safety net; it offers you peace of mind. Knowing that your investments are secure from unexpected setbacks provides a sense of security that’s hard to put a price on. No one wants to be caught off guard when disaster strikes, and with this added layer of protection, you can sleep soundly, confident that your investments are in good hands.

Cost Savings in the Long Run

While it may seem like an added expense initially, property additional coverage can translate to substantial savings in the long run. By preventing unforeseen financial burdens caused by property damage or loss, this coverage ensures that you won’t have to dig deep into your pockets to cover unexpected repairs or replacements. It’s an investment in itself, sparing you from potential financial setbacks.

Making Informed Decisions

Assessing Your Property’s Unique Risks

To safeguard your investments effectively, it’s imperative to start by understanding the specific risks your property faces. Each property is unique, and potential threats may vary greatly. Begin by assessing your property’s location, considering climate, natural disasters, and the local crime rate. By pinpointing these individual risks, you can tailor your coverage to address them precisely.

Working with an Experienced Insurance Agent

Collaborating with an experienced insurance agent is a wise move in your quest for robust property coverage. These professionals possess in-depth knowledge of the insurance landscape and can help you navigate the complexities. They will work closely with you to identify the right policy and understand the nuances of your property. An expert insurance agent can offer valuable insights and ensure you make informed decisions regarding your coverage.

Evaluating Costs and Coverage Options

Balancing cost and coverage is a critical aspect of property insurance. It’s essential to scrutinize available insurance options, assessing the value they provide versus their associated costs. You can optimize your coverage by carefully evaluating different plans while staying within your budget. Remember that the goal is to strike the right balance, ensuring that you have adequate protection without overextending financially.

Property Additional Coverage, your financial safety buffer, bridges the gaps in standard policies, offering enhanced protection and peace of mind. By assessing unique risks, collaborating with expert insurance agents, and balancing costs prudently, you can fortify your investments against unexpected challenges. Remember, informed decisions today pave the way for a secure tomorrow.

Publisher’s Details:

Avnar Gat

4918 E Stearns St, Long Beach, CA 90815, United States

(818) 917-5256

avnergat.com

info@avnergat.com

When it comes to fortifying your property investments with the right coverage, consider consulting a trusted public adjuster in Irvine. They can provide valuable insights and ensure that you make informed decisions regarding your property insurance. To explore your insurance options and enhance your protection by experienced public adjusters in Irvine, CA, visit Avner Gat Public Adjuster for expert guidance and tailored solutions.

<iframe src=”https://www.google.com/maps/embed?pb=!1m18!1m12!1m3!1d3315.6381965018722!2d-118.13812899999999!3d33.7958401!2m3!1f0!2f0!3f0!3m2!1i1024!2i768!4f13.1!3m3!1m2!1s0x80dd315de941b405%3A0xde7a08e2ca224888!2sAvner%20Gat%20Public%20Adjusters!5e0!3m2!1sen!2s!4v1698863048252!5m2!1sen!2s” width=”600″ height=”450″ style=”border:0;” allowfullscreen=”” loading=”lazy” referrerpolicy=”no-referrer-when-downgrade”></iframe>