Introduction –

The huge rush in web-based business and the shift towards computerized payment strategies have made an extraordinary requirement for excellent payment processing. On the off chance that you’re endeavouring to assist businesses with developing by upgrading their payment capacities, beginning a merchant services business is the best approach. Be that as it may, a way towards industry initiative is flung with deterrents, and committing errors can be expensive for rookies. Also, you will get to know some of the few things about, how to start a payment processing company? And what are its essentials. This total aide gives inside and out data pretty much all parts of beginning a merchant services organization. How about we quit wasting time.

Merchant Services Defined –

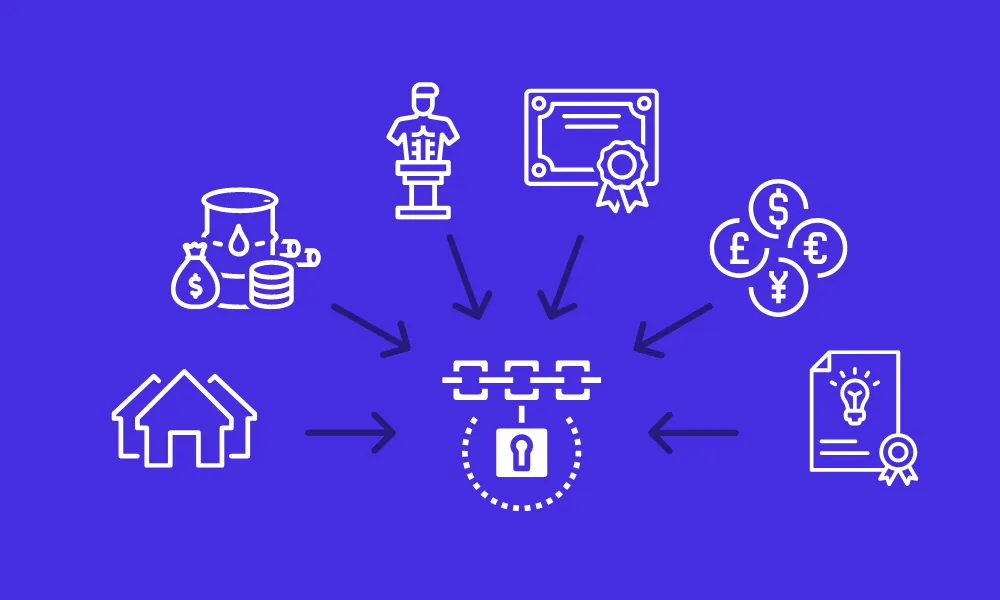

To move from simple to complex one small step at a time, we’ll begin with some fundamental phrasing that each newcomer in merchant services ought to be aware. Merchant services (frequently called credit card processing) is a wide term to depict services that empower merchants to acknowledge, process, and oversee electronic exchanges from their clients. Merchant services providers act as important aides in the domain of payments for business proprietors, outfitting them with every one of the basics expected to acknowledge payments easily, including first class programming, equipment, and expert help. Merchant services are a leaping off point for each business, empowering them to acknowledge different payment techniques, handle numerous monetary standards, and oversee exchanges. Cooperating with a merchant specialist co-op permits organizations to extend their payment choices and enter new business sectors with negligible exertion. Such clear benefits produce an overwhelming interest in merchant services among businesses of various ventures and sizes, making this specialty worthwhile and appealing to enter.

Important Steps towards Merchant Services Business –

Before you set out on this challenging excursion, become familiar with these basic moves toward making a merchant services business.

1. Research the business and market –

Your future merchant services organization’s prosperity relies upon the carefulness of the examination you direct prior to beginning it. This is particularly obvious in the payment business, where things are changing excessively fast, and some of the time it’s difficult to stay aware of recent fads. Other than the possibility review, assemble the most recent information about comparative businesses, merchant services they give, and their estimating strategy. Unique consideration ought to be given to the degree of rivalry in the business. Typically, the greater providers get more conspicuous merchants. In any case, it’s simpler for more modest merchant services providers to get nearby clients ready.

2. Settle on the services you’ll give –

There is a colossal assortment of contributions that a merchant services provider can propose to clients. In light of the inclinations of your main interest group, decide the services that will be generally pertinent to them. Here is a concise outline of the most widely recognized merchant services: To acknowledge charge and credit card payments and computerized payment techniques, each business will require a merchant account where assets from all handled exchanges will be stored. A few providers offer turnkey merchant accounts; however, they can likewise enrol clients as sub-merchants, furnishing them with extraordinary merchant IDs. Whether you can offer the first or subsequent choice relies upon the kind of your mixes with the PSPs and banks.

3. Payment gateways

A payment gateway is a piece of programming that lays out an association between a merchant’s site and members in payment processing. It scrambles delicate client data and sends it safely for additional processing. Each merchant who means to acknowledge online payments will require a payment gateway, so it will be popular in your rundown of services.

4. Retail location (POS) frameworks –

One more effective method for bringing in cash for merchant services providers is to sell POS (Point of Sales) frameworks that join every one of the devices for consistent payment acknowledgment. The POS framework is programming that permits merchants to acknowledge different payment strategies, including contactless ones, track cash payments and sales, do vital computations, and considerably more. Contingent upon the store type (on the web or blocks and concrete), merchants may likewise require equipment, for instance, a credit card per user, receipt printer, or any web empowered gadgets to handle exchanges.

5. Web based shopping baskets

A shopping basket is a piece of programming that merchants coordinate to make charming shopping encounters for their clients. Going about as an internet-based index, the shopping basket monitors things that a purchaser chooses on a merchant’s site, frames a request and shows all the essential data about it to the purchaser. Custom shopping basket incorporation is the way to fruitful sales for internet business retailers.

Also, the ISO Agent Program facilitates a transformative journey into the world of electronic payment solutions. Armed with merchant services, card processing, and fraud prevention know-how, ISO agents become invaluable players in the financial technology landscape. Through comprehensive training and support, they lead the charge, shaping a seamless and secure digital payment ecosystem.