Investing in the UK stock market offers many opportunities for seasoned investors and newcomers looking to grow their wealth. As one of the world’s leading financial hubs, the UK stock market is home to various companies representing various sectors and industries.

This article delves into the opportunities and risks associated with investing in the UK stock market, providing insights into the potential rewards and pitfalls investors should be aware of.

Diversification through blue-chip companies

The UK stock market boasts a strong presence of blue-chip companies, well-established and financially stable corporations with a proven track record of success. These companies often have significant market capitalization and are leaders in their respective industries.

Investing in blue-chip companies provides stability and diversification to a portfolio. These companies are typically less susceptible to market volatility and economic downturns than smaller, more volatile ones. Blue-chip stocks often pay dividends, making them attractive to income-seeking investors.

While blue-chip companies offer stability, they may also experience slower growth than smaller, high-growth companies. As a result, investors seeking higher returns may need to balance their portfolios with a mix of blue-chip and growth-oriented stocks.

Exploring growth stocks in emerging industries

The UK stock market is also home to numerous growth stocks, especially in emerging technology, renewable energy, and biotechnology industries. Investing in growth stocks can offer the potential for substantial returns as these companies capitalise on innovative technologies and market opportunities.

Growth stocks tend to reinvest their profits into research and development, expanding their market presence and driving future growth. While these stocks can be highly rewarding, they also carry higher risks due to their potential for greater price volatility. Investors interested in growth stocks should conduct thorough research and have a higher risk tolerance.

One of the benefits of the UK stock market is its proximity to the global financial landscape. Many growth companies on the UK stock exchange have a global presence, providing investors who trade through reputable institutions such as Saxo Bank with exposure to international markets and opportunities.

Considering dividend stocks for passive income

Dividend stocks have long been favoured by income-oriented investors seeking passive income. These stocks are issued by companies that regularly distribute a portion of their profits to shareholders as dividends.

Investing in dividend stocks can provide a steady income stream, making them attractive to retirees and those seeking to supplement their earnings. Dividend stocks can also cushion during market downturns, providing stability to a portfolio.

Assessing the sustainability of dividend payouts before investing is crucial. Some companies may have unsustainable dividend policies, leading to potential cuts or suspensions in dividend payments. Investors should focus on companies with a history of consistent dividend payments and solid financial health.

Analysing risks and mitigating strategies

While the UK stock market offers promising opportunities, it has its risks. Market volatility, economic uncertainties, geopolitical events, and industry-specific risks can all impact the performance of individual stocks and the market.

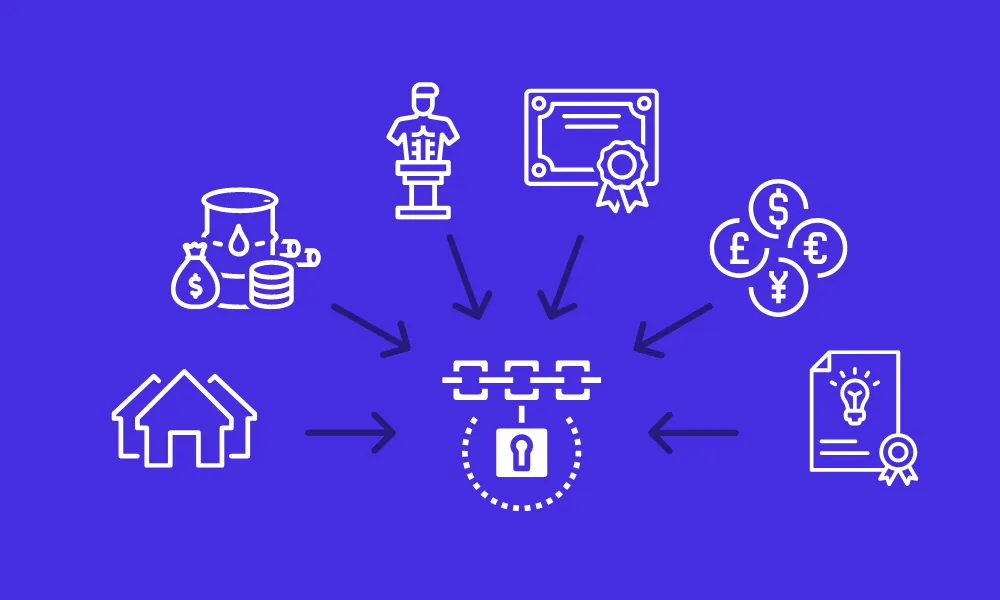

One way to mitigate risks is through diversification. By spreading investments in stocks across different sectors and asset classes, investors can reduce their exposure to any single company or industry. Diversification can provide a buffer against market fluctuations and improve the overall stability of a portfolio.

Another risk mitigation strategy is conducting thorough research and staying informed about market trends and economic developments. Well-informed investors can make more strategic decisions and better navigate changing market conditions.

Investors should establish clear investment goals and time horizons. Understanding personal risk tolerance and aligning investments accordingly can help manage emotional responses to market fluctuations.

The impact of economic indicators on the UK stock market

Economic indicators play a significant role in shaping the performance of the UK stock market. Key indicators such as GDP growth, inflation rates, unemployment rates, and consumer sentiment can influence investor confidence and market sentiment. For instance, strong GDP growth and low unemployment rates indicate a healthy and growing economy, which can boost investor optimism and drive higher stock prices.

Rising inflation or economic downturns may create uncertainty, making investors more cautious and potentially impacting stock valuations.

Investors should closely monitor economic indicators and their potential impact on the stock market. By understanding how macroeconomic factors interact with the market, investors can make more informed decisions and adjust their investment strategies accordingly.

All in all

Investing in the UK stock market presents many opportunities for investors seeking to grow their wealth and achieve their financial goals. The UK stock market offers something for every investor, from stable blue-chip companies to high-growth stocks and dividend-paying firms.

However, it is essential to remember that all investments carry some level of risk. Understanding each investment’s potential rewards and pitfalls is crucial to making informed decisions.